Q2 2025 Multifamily Highlights

Q2 2025 NYC Multifamily Report

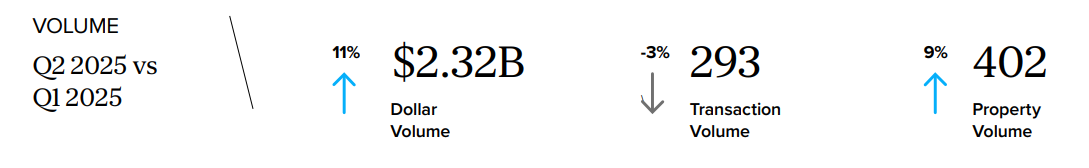

The New York City multifamily market showed modest growth in the second quarter of 2025. While transaction volume saw a minimal decline, driven by fewer sales in the MF-MU category, total dollar volume rose 11% from the previous quarter. Compared to the quarterly average since the first quarter of 2023, Q2 2025 transaction activity was up 4% and dollar volume increased by 10%. Investment was varied, with affordable housing properties leading in dollar volume, alongside activity in free-market and rent-stabilized assets.

Pressure on Rent-Stabilized Drives Increased Transaction Activity

- Increased investment in rent-stabilized properties is fueled by owner distress. Current landlords are struggling with the impact of the HSTPA, rising expenses, and difficult refinancing terms. This has created opportunities for buyers to purchase these assets at a significant discount, anticipating that today’s challenging regulations may eventually be revised.

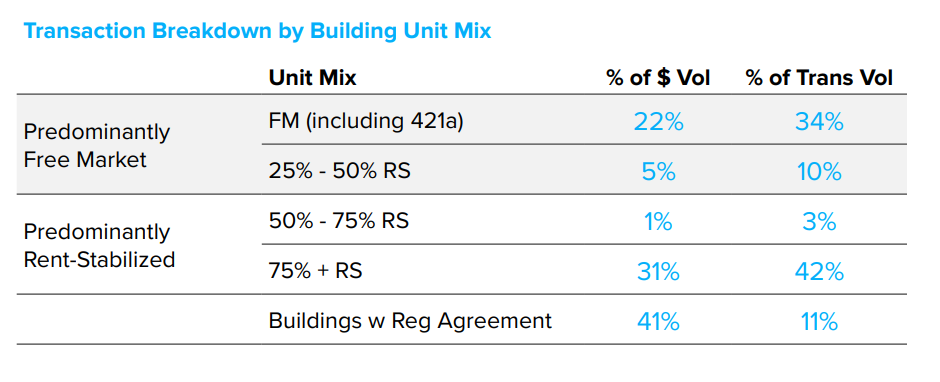

- The result is shown in the numbers as rent-stabilized property transactions slightly outpaced free-market assets in total dollar volume, accounting for 32% and 27% of total dollar volume, respectively. The most significant transaction in the rent-stabilized sector this quarter was the sale of Related Companies’ Bronx portfolio to PH Realty Capital LLC for $189 million. The portfolio consists of 36 buildings with a total of 2,014 units located throughout the northern Bronx, including the Kingsbridge, University Heights, Pelham Parkway, Norwood, and Wakefield neighborhoods. The sale, finalized on May 16, 2025, represents a considerable discount from the $253 million that Related paid for the same properties in 2014. PH Realty Capital LLC has stated its intention to invest in the portfolio by returning 264 vacant units to the rental market and resolving thousands of outstanding building violations.

Brooklyn continues to lead Borough Rankings

- In Q2 2025, Brooklyn dominated New York City’s real estate market, accounting for $1.06 billion in sales across 135 transactions, nearly half of the citywide activity. Investor focus was heavily skewed towards smaller, sub–10-unit buildings, which comprised 109 of the borough’s 135 trades. This interest is driven by the fact that smaller assets are subject to less rent regulation, including “good cause” eviction, and often receive more favorable tax treatment.

- In a notable free-market transaction, The Carlyle Group and Z+G Property purchased a 51-unit building at 202 8th Street in Gowanus for $32.1 million. The price reflects a 15% drop from its $37.8 million sale price in 2013. This decrease in value is primarily attributed to the upcoming expiration of its 421-a tax benefit and the impact of the Housing Stability and Tenant Protection Act (HSTPA), which complicates moving units to market rates once the tax exemption ends.

Notable Investment Activity within the Affordable Housing Space

Investment in the affordable housing sector totaled 41% of overall multifamily dollar volume, the highest mark since Nuveen’s acquisition of Omni’s Affordable Housing Platform in Q2 2023. This marks a significant rebound from Q1 2025, as four of the five largest multifamily transactions during the quarter were affordable housing deals, underscoring the strong demand for affordable housing within NYC, with private, mission-driven, and institutional players all active.

Selected Transactions within this sector include:

- Tredway and Brookfield’s acquisition of the 607-unit Ocean Park Apartments, 125 Beach 17th St, in Far Rockaway from Related Companies for $88 million, a deal brokered by Ariel Property Advisors. Ranking as the quarter’s third-largest multifamily deal, the purchase included a new regulatory agreement with HPD to preserve affordability. Tredway plans extensive structural repairs, climate resiliency upgrades, and the introduction of new resident services, including expanded food distribution and swim programming.

- Phoenix Realty Group purchased the 314-unit Soundview complex at 820-880 Thieriot Ave & Leland Ave in the Bronx from Camber Property Group for $54.5 million in May 2025. The sale of the two Mitchell-Lama properties and a vacant lot, all located on the same block, recently underwent over $20 million in upgrades.

The NYC Q2 2025 Multifamily Quarter in Review is available here.