2025 Mid-Year Overview

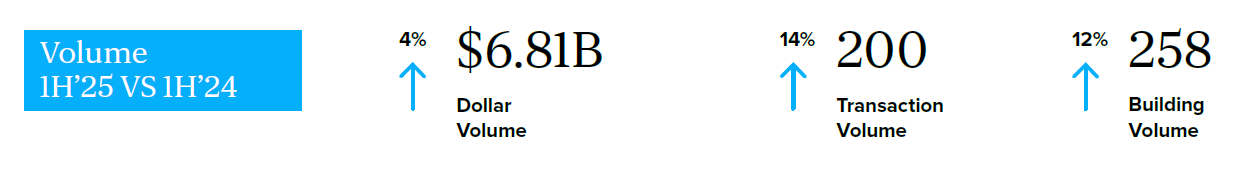

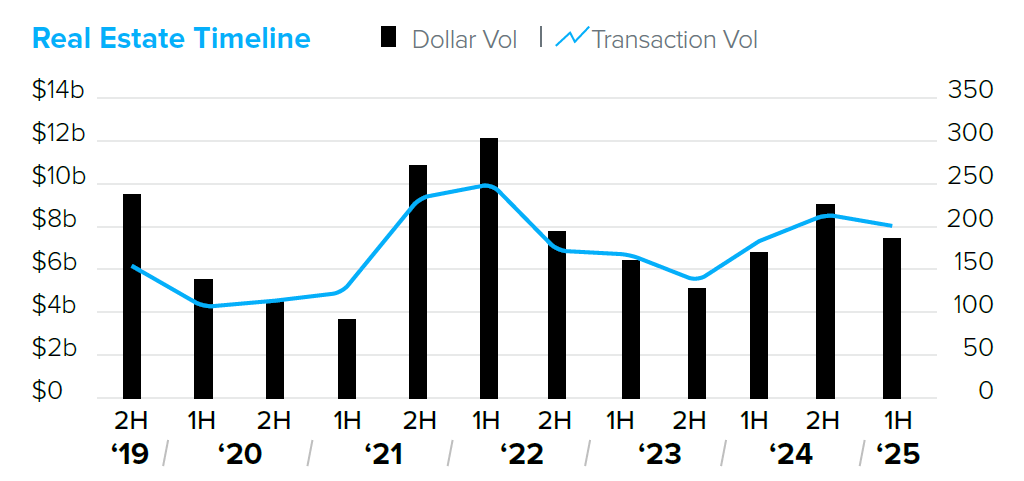

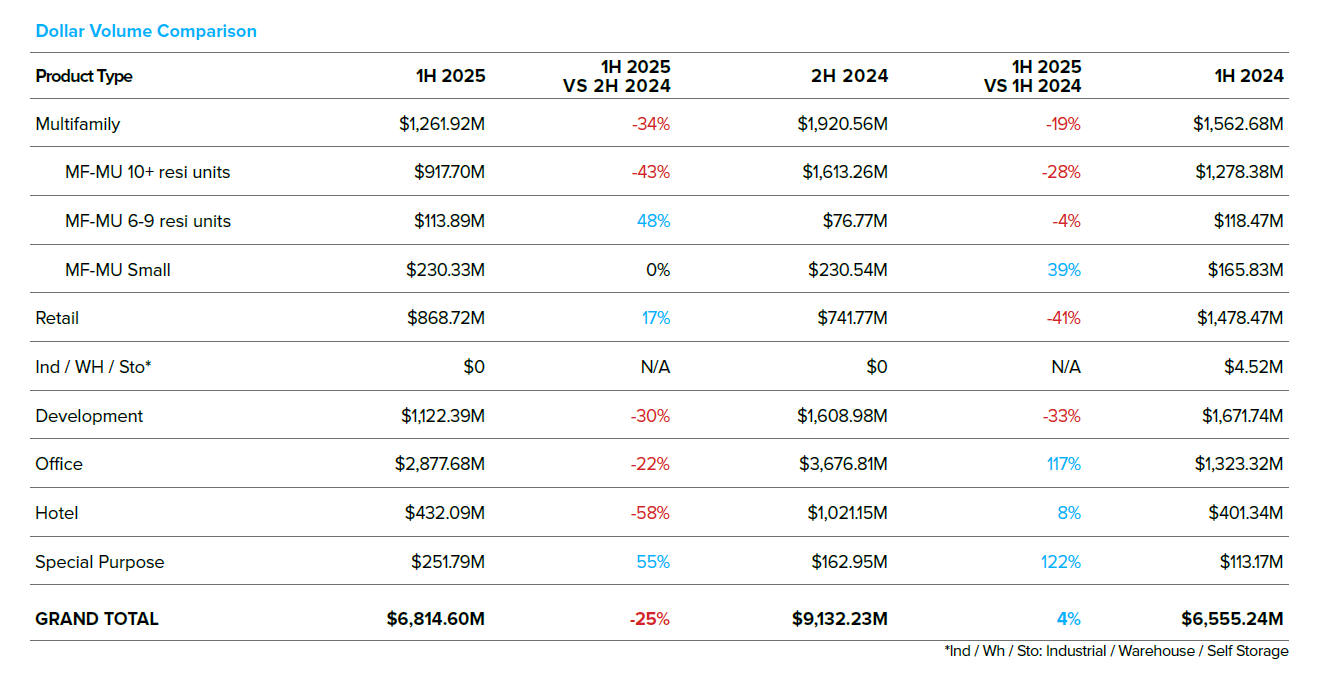

Manhattan’s real estate market demonstrated resilience and modest growth in the first half of 2025, with $6.81b in dollar volume (4% increase Y-O-Y) and 200 transactions (14% increase Y-O-Y).

Multifamily fundamentals remained solid: rents held high, vacancies stayed near historic lows, and private equity and family offices targeted both core and valueadd plays.

Luxury condo deals and large construction loans signaled long-term confidence in development, though lending was more selective, dependent on asset type.

Office leasing rebounded as law, tech, and finance firms drove demand for trophy assets in Class A properties, while conversions began to help absorb surplus inventory from older vintage buildings.

Retail gained momentum with global brands investing in flagship stores, reflecting cautious optimism about the strength of foot traffic and consumer spending.

Policy moves designed to increase quality housing, like the “City of Yes” and Midtown South rezoning, laid the groundwork for future growth. Overall, investors demonstrated prudent optimism for sustained recovery.

2025 Mid-Year Outlook

Manhattan’s real estate market continues to attract capital, although investors remain selective given macro risks. Persistent high interest rates are reshaping deal structures and investor return expectations, with cap rates diverging sharply by asset type. Prime luxury multifamily and Class A office assets are still commanding relatively low cap rates given the demand for cash-flowing assets. Rent-stabilized multifamily properties, however, are seeing an increase in distress.

New York’s market trajectory depends heavily on the direction of interest rates, how tariffs could affect input costs, and whether upcoming local elections derail recent pro-housing zoning reforms. Lenders continue to back well-located conversions and luxury developments, seen in major construction financings, but their underwriting remains conservative.

In sum, Manhattan remains globally attractive, with luxury multifamily and high-end office remaining in high demand, a robust pipeline of conversions, and policy shifts poised to expand residential capacity. Investors are proceeding with cautious optimism, focusing on location, asset quality, and the evolving regulatory landscape as keys to sustaining growth.

The Manhattan 2025 Mid-Year Commercial Real Estate Trends report is available here.