2025 Mid-Year Overview

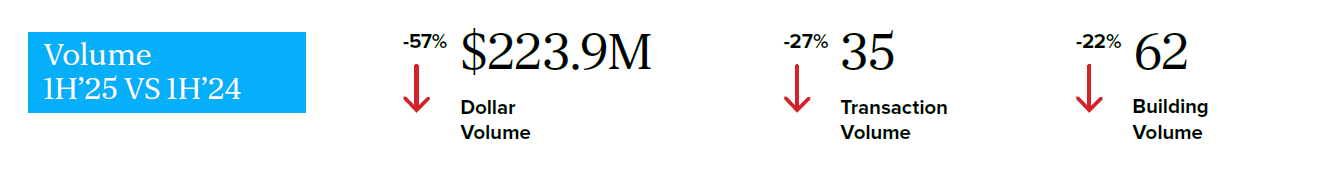

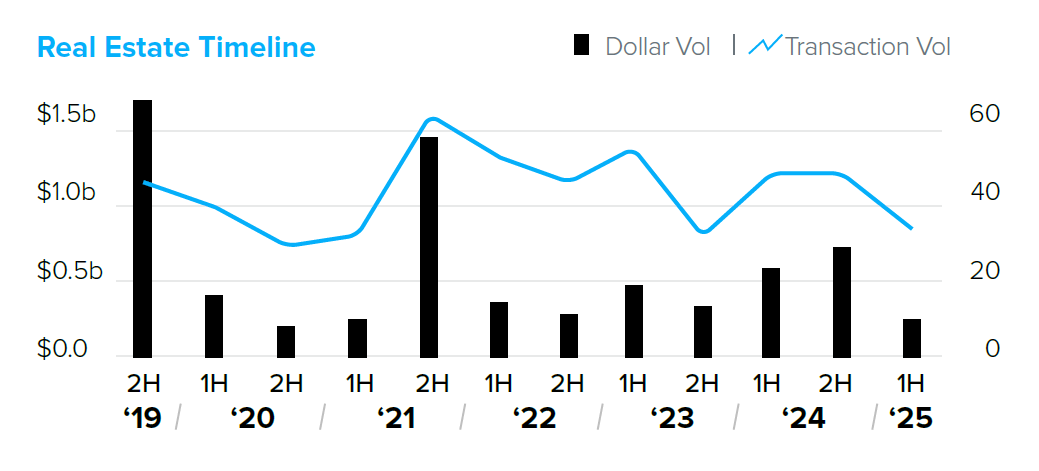

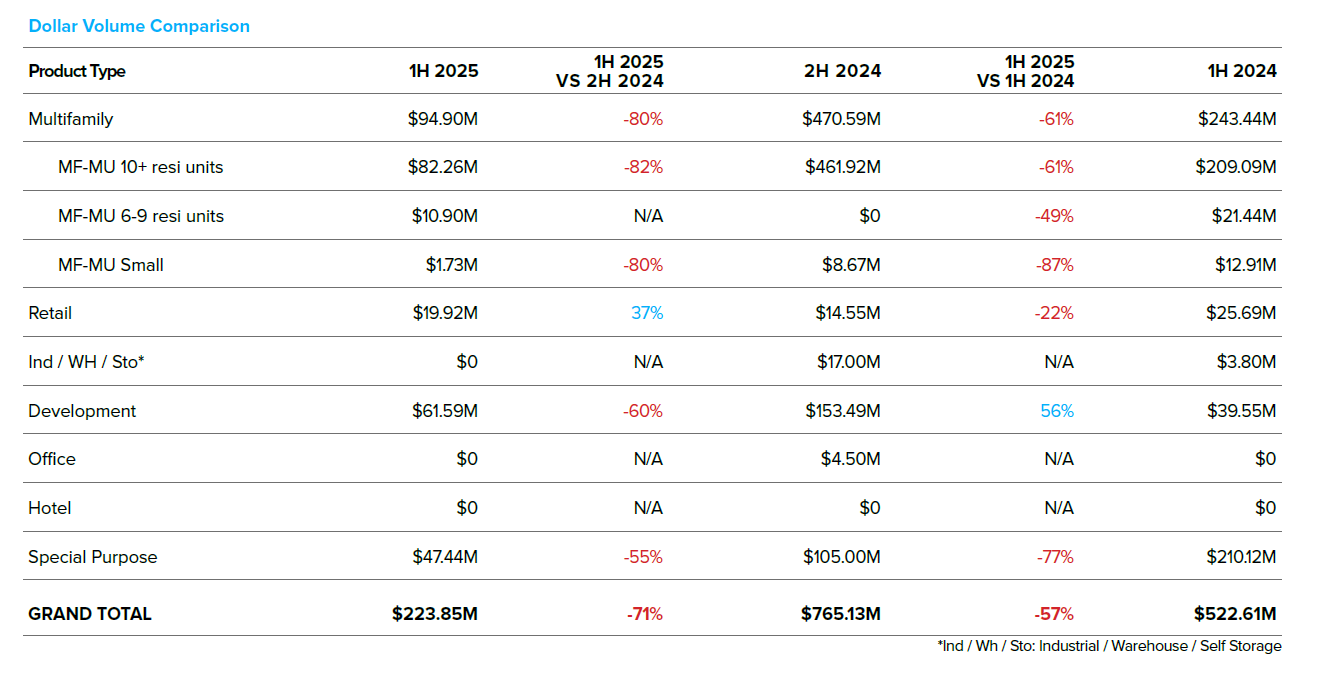

The first half of 2025 was tough for Northern Manhattan’s investment sales market. Dollar volume dropped 57% to $224 million, the second-lowest in a decade after H2 2020. Transaction volume fell 27% year-over-year, with just 35 trades. Many multifamily sales were distressed foreclosures, with values falling 50% to 60% from previous prices due to over-leveraging and ongoing impacts of the Housing Stability and Tenant Protection Act of 2019 (HSTPA).

The development sector was the only asset class with year-over-year gains, rising 56% in dollar volume and 43% in transactions. Still, both remain 40% and 19% below the decade’s half-year averages. Growth was driven by the housing crisis and government programs like City of Yes and 485-x tax incentives. Community revitalization efforts and infrastructure projects, including the East Side Coastal Resiliency and 2nd Ave Subway projects, are driving developer interest in specific locations. For example, East Harlem was the most active neighborhood, with 50% of transactions and 70% of dollar volume.

2025 Mid-Year Outlook

The New York City commercial real estate market is entering the second half of 2025 with a complex mix of challenges and opportunities, driven by both global economic trends and crucial local policy shifts. While geopolitical tensions and elevated, albeit stabilizing, interest rates create a cautious environment, a significant surge in foreign investment and strategic development initiatives are bolstering confidence.

The “Big Beautiful Bill” brings significant capital investment incentives. Its permanent reinstatement of 100% bonus depreciation and the new allowance for “Qualified Production Property” will notably boost industrial development and redevelopment. This bill also permanently expands the LIHTC program, making affordable housing development significantly more feasible across the borough, particularly in areas with available land and a community need.

Despite political anxieties, strong market fundamentals persist. Multifamily demand remains robust across boroughs, driving growing rents and limited supply in the free market sector. Development is stimulated by “City of Yes” zoning reforms and the 485-x and 467-m tax abatements, encouraging new construction and office-to-residential conversions. The market is shifting from defensive to strategic capital deployment, focusing on location, asset quality, and adaptability.

The Northern Manhattan 2025 Mid-Year Commercial Real Estate Trends report is available here.