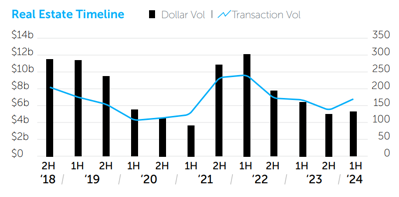

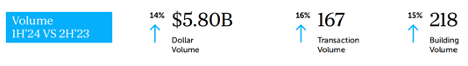

NEW YORK, NY – July 30, 2024 – Investment sales in Manhattan rose to $5.8 billion over 167 transactions in 1H 2024, a 14% and 16% increase, respectively, compared to 2H 2023, according to the Manhattan 2024 Mid-Year Commercial Real Estate Trends report produced by Ariel Property Advisors, a member of GREA.

“In the first half of 2024, we saw investor sentiment in Manhattan shift noticeably from the second half of 2023’s more conservative approach,” said Howard Raber, Director of Ariel Property Advisors. “Consequently, sellers facing mortgage maturities and distress began making tough decisions about their assets and buyers capitalized on the lower prices.”

Retail trades accounted for nearly 27% of all of Manhattan’s investment sales dollar volume in the first six months of the year, a higher level than any other asset class because luxury retailers made significant acquisitions on the world’s most expensive and exclusive commercial corridors.

“The office market also showed signs of improvement in 1H 2024 driven by a number of owner-user purchases,” Ariel Founding Partner Mike Tortorici said. “Additionally, the development market improved with approximately 50% of Manhattan’s $1.1 billion development sales reportedly slated for office to residential conversions. This trend is a direct result of initiatives put forward by both the city and the state to make conversions more feasible to help combat New York City’s housing shortage.”

The following is a summary of the performance of each asset class in Manhattan in 1H 2024:

Retail

- The dollar volume of retail sales grew 25% compared to H2 2023 to $1.55 billion across 16 transactions.

- Noteworthy transactions included luxury retailer Kering (which owns brands Gucci, Balenciaga, and Yves Saint Laurent) spending $963 million on retail condos plus office totaling 115,000 SF at 715-717 Fifth Avenue.

- Prada,which acquired its flagship store at 724 Fifth Avenue and neighboring 720 Fifth Avenue for a total of $835 million in 2023, picked up an additional site at 730 Fifth Avenue in 1H 2024.

- Thor Equities sold its 680 Madison Avenue retail site for $180 million, a 35% discount off the original purchase price of $277 million in 2013.

Multifamily

- In 1H of 2024, Manhattan saw 90 multifamily sales totaling $1.39 billion, a 14% increase in transaction volume and 8% increase in dollar volume from 2H 2023. Of the dollar volume, 80% were properties with 10+ units.

- Compared to last year, average pricing dropped by 15% from $722/SF to $611/SF, while average cap rates increased from 5.24% to 6.19%. Predominantly free market buildings sold for just $679/SF, the lowest level since 2013.

- The most notable transaction was 200 West 67th Street, a 310-unit luxury rental tower acquired by Carlyle and Gotham Organization for $265 million, or $678/SF. The building faced the expiration of roughly $194 million in mortgage loans maturing in November while also dealing with the burn-off of the 421-a tax exemption that saw taxes increase from $1.1 million to $6.6 million.

Office

- Office sales totaled $1.18 billion across 23 transactions in 1H 2024, a 38% and 21% increase, respectively, from 2H 2023 as mortgage maturities forced activity. (Note: in this report office buildings sold as reported conversions to residential are counted in the development totals, not the office totals.)

- The most notable transaction was the purchase of 980 Madison Ave by the building’s anchor tenant Bloomberg Philanthropies for $560 million or $4,720/SF.

- Other owner user acquisitions included New Tang Dynasty TV’s purchase of 129 West 29th Street for $31 Million ($360/SF), Magna Publisher Kodansha’s acquisition of 25 East 22nd Street for $27 Million ($1,350/SF), and Gourmet Food Products’ purchase of 148 Madison Avenue for $31 Million ($436/SF).

Development

- Development sales totaled $1.12 billion in 1H 2024, a 128% increase from 2H 2023, and transactions totaled 28, an 115% increase over this period. As noted, reported office to residential conversions accounted for approximately 50% of the dollar volume.

- The state’s recently approved housing policy introduced the 467-m tax exemption to help facilitate conversions, which is reminiscent of the 421-g tax abatement that spurred the conversion of about 13 million SF of office space to residential use in Lower Manhattan between 1995 and 2006. The new housing policy also lifted the 12 FAR density cap.

- The city has created the Conversion Accelerator Program to facilitate conversions by streamlining the review process among city stakeholders, and conversions are part of the City of Yes, which the city will vote on at the end of the year.

Hotel

- Five hotels valued at $435 million traded in 1H 2024, a 38% decline in transaction volume and 60% decline in dollar volume from 2H 2023.

- A 1,331-key hotel at 700 8th Ave, which traded for $275 million, was the largest sale. The city is currently using the hotel as a migrant shelter.

- With a special permit requirement for building new hotels, rooms set aside for migrants, a ban on short-term rentals, and an overall increase in post-Covid tourism activity, hotel occupancy has risen to nearly 90%.

Ariel Property Advisors’ Manhattan 2024 Mid-Year Commercial Real Estate Trends report is available here.