2025 Mid-Year Overview

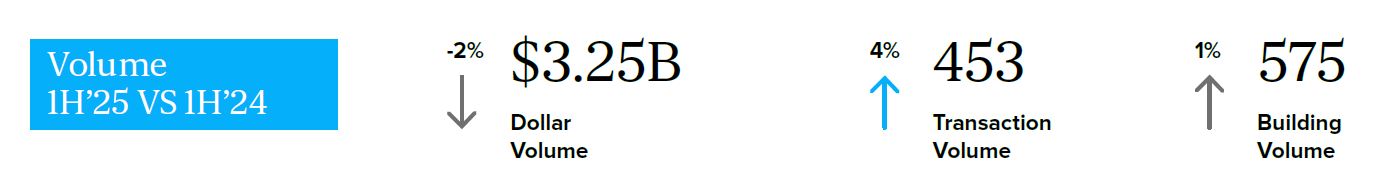

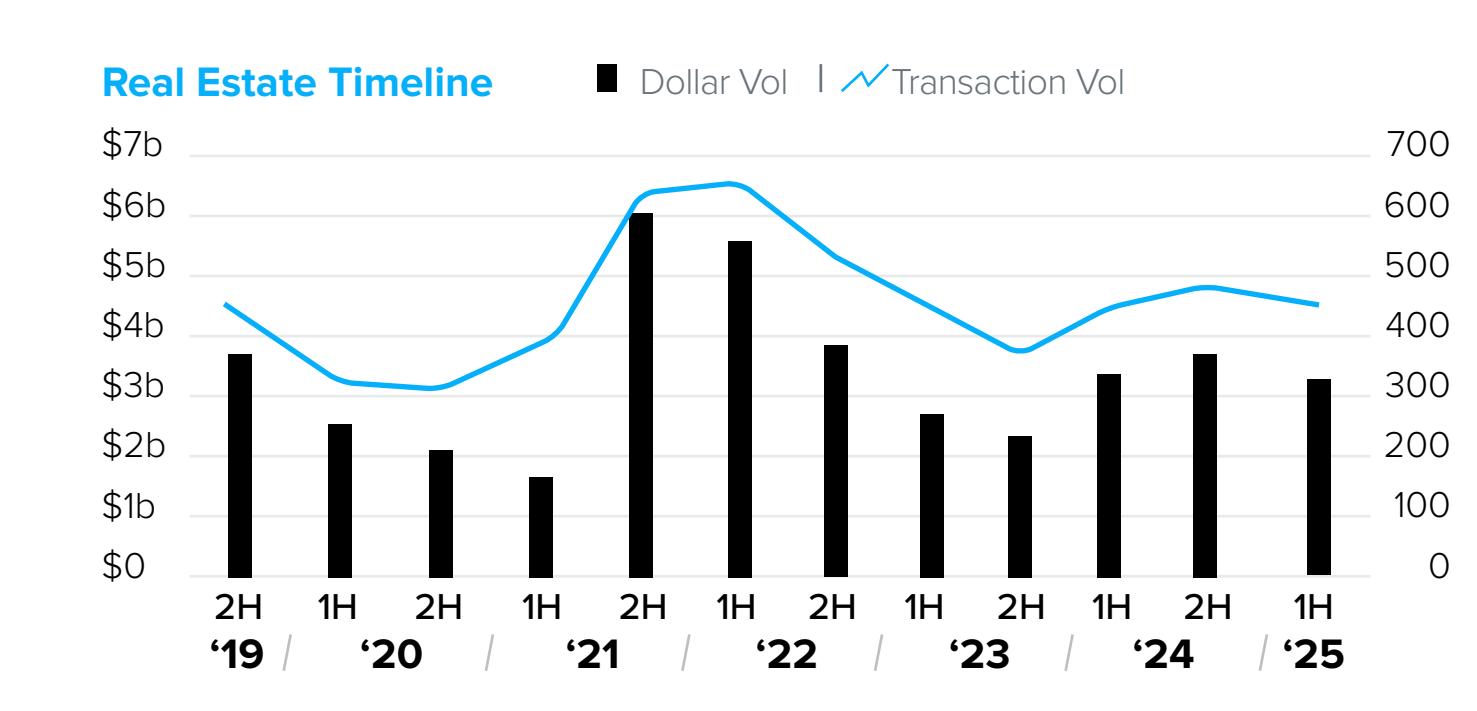

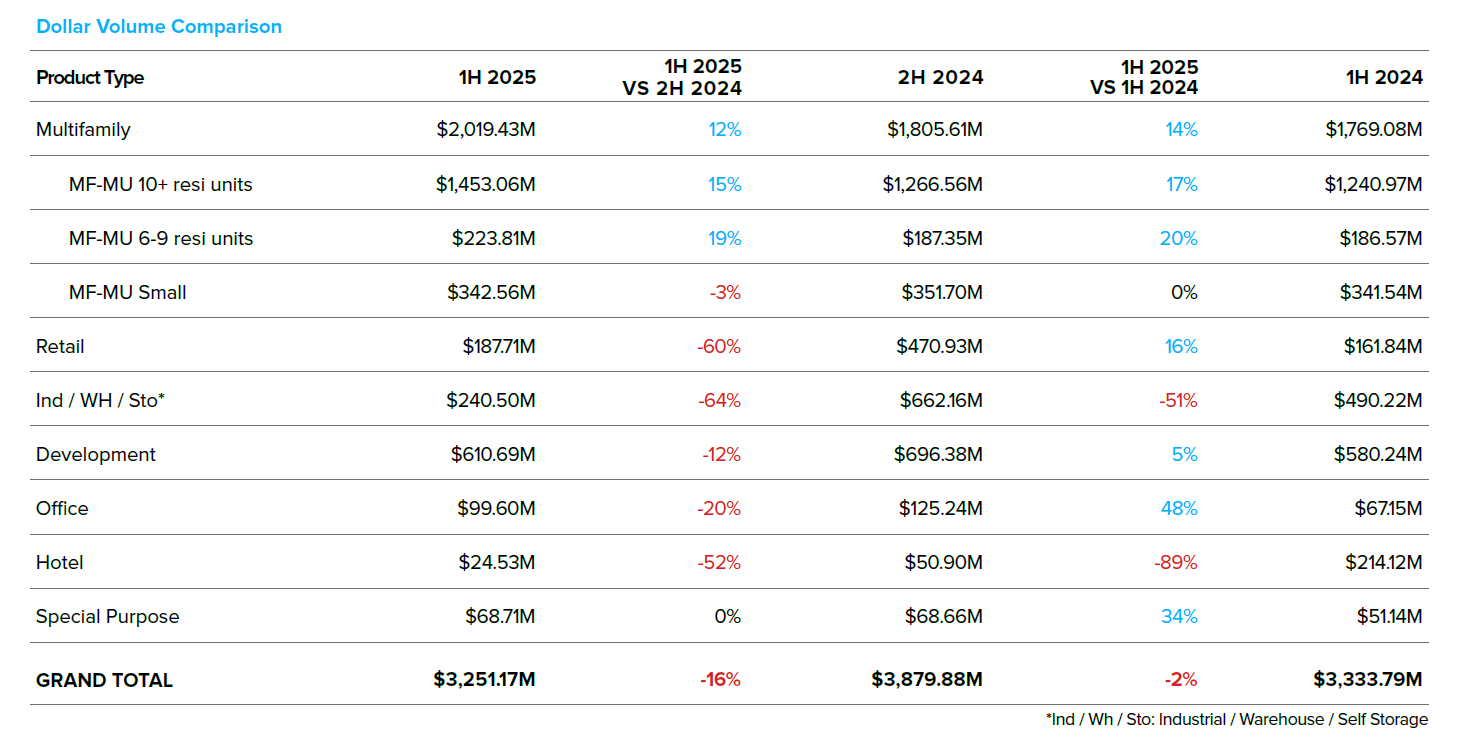

Following a strong 2024, Brooklyn recorded 453 investment sales totaling $3.25 billion in 1H25, a modest 4% uptick in transaction volume but a 2% drop in dollar volume vs. 1H24. Excluding 2024’s $672 million deed-in-lieu sale of 9 Dekalb, which was an outlier and Brooklyn’s 2nd largest transaction ever, 1H25 actually outpaced 1H24.

Macroeconomic headwinds, such as uncertainty around tariffs and trade policy, have added a layer of caution to the market, tempering investor sentiment despite localized momentum. Meanwhile, zoning initiatives like “City of Yes,” the Gowanus rezoning, and the Atlantic Avenue Mixed Use Plan (AAMUP) continue to boost development and land values. 1H25’s average price per buildable square foot of $313 is on pace to be the highest ever recorded, surpassing the $296 per buildable square foot number from 2023. Williamsburg remained the standout submarket, finishing 1H25 with 45 transactions totaling $472 million, both first in the borough.

2025 Mid-Year Outlook

The New York City commercial real estate market is entering the second half of 2025 with a complex mix of challenges and opportunities, driven by both global economic trends and crucial local policy shifts. While geopolitical tensions and elevated, albeit stabilizing, interest rates create a cautious environment, a significant surge in foreign investment and strategic development initiatives are bolstering confidence.

The “Big Beautiful Bill” brings significant capital investment incentives. Its permanent reinstatement of 100% bonus depreciation and the new allowance for “Qualified Production Property” will notably boost industrial development and redevelopment. This bill also permanently expands the LIHTC program, making affordable housing development significantly more feasible across the borough, particularly in areas with available land and a community need.

Despite political anxieties, strong market fundamentals persist. Multifamily demand remains robust across boroughs, driving growing rents and limited supply in the free market sector. Development is stimulated by “City of Yes” zoning reforms and the 485-x and 467-m tax abatements, encouraging new construction and office-to-residential conversions. The market is shifting from defensive to strategic capital deployment, focusing on location, asset quality, and adaptability.

The Brooklyn 2025 Mid-Year Commercial Real Estate Trends report is available here.