2025 Mid-Year Overview

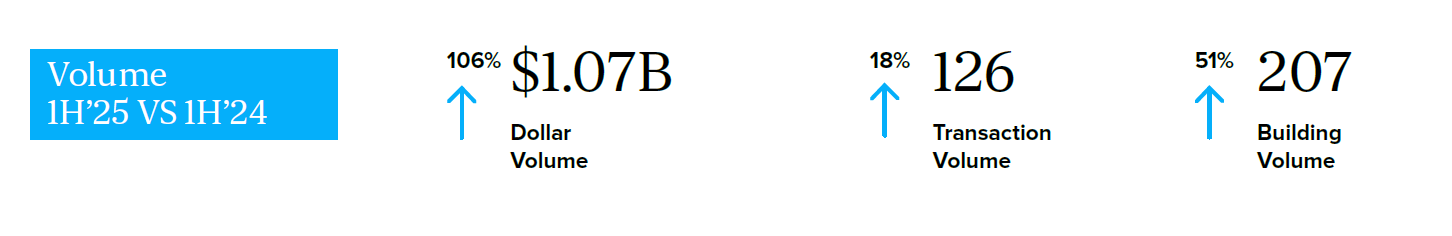

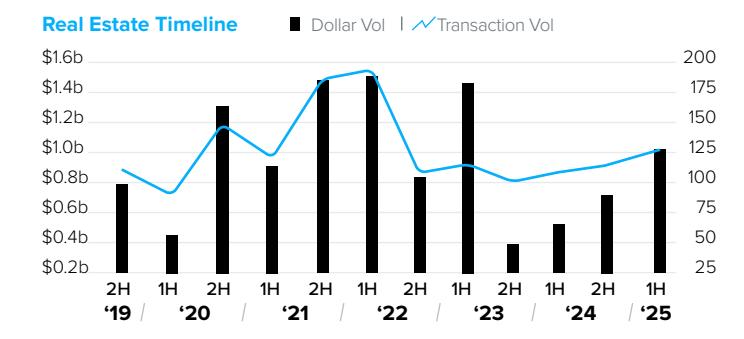

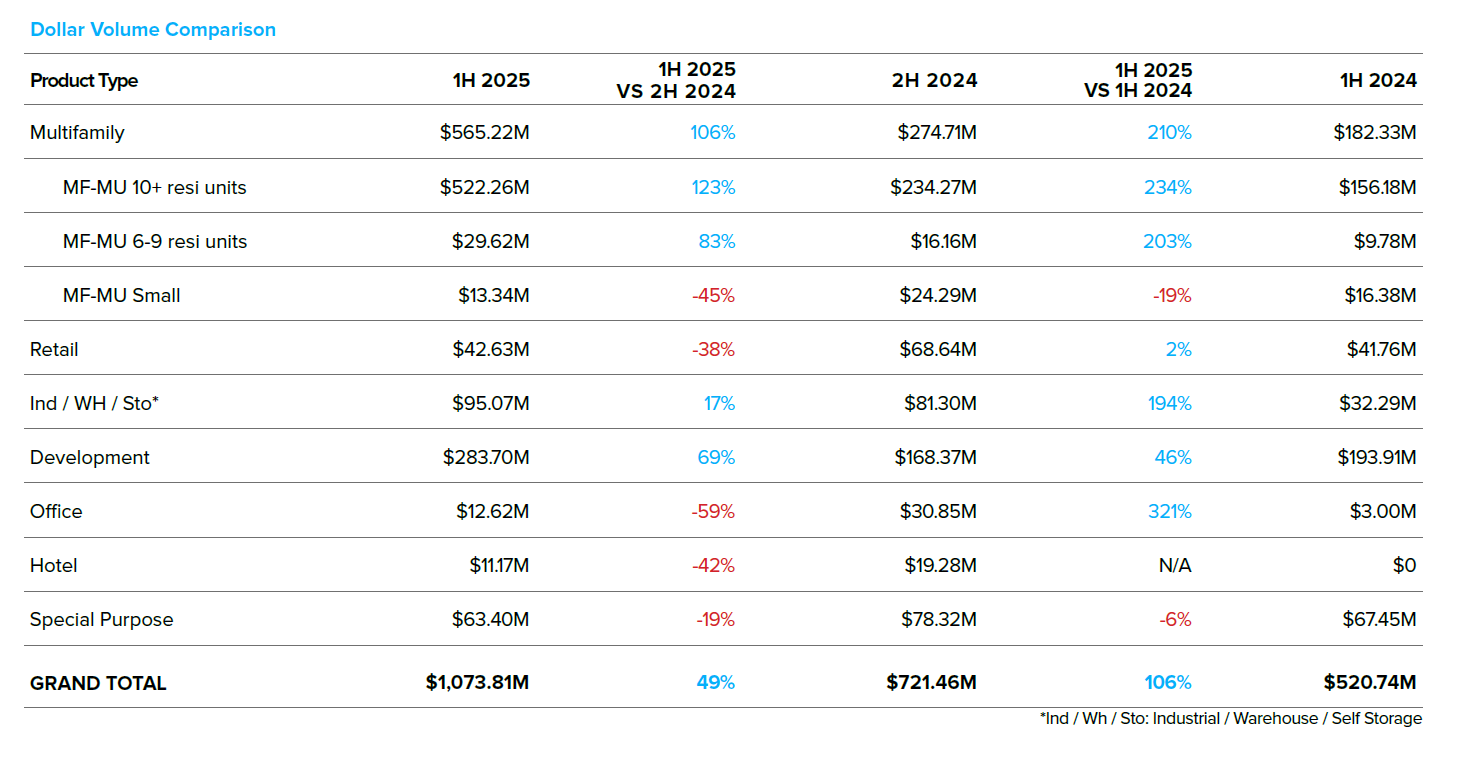

The Bronx investment sales market experienced a significant recovery in the first half of 2025, with increases in dollar and transaction volume on a half-over-half and year-over-year basis.

Institutional investors drove this momentum, closing seven sales over $30 million the most since H1 2022. Activity in the multifamily sector was generated by owners of rent stabilized assets under pressure to sell. The most significant trade was Related Companies sale of a rent stabilized portfolio for $195.5M, discounted from $253M paid in 2014. Development sales benefited from pro-housing policies like the Bronx Metro-North rezonings, “City of Yes,” and 485-x tax abatement.

The borough’s future growth is underscored by the MTA’s $3 billion Metro-North Penn Station Access project. Metro-North will acquire eight properties in the Bronx to build a new rail infrastructure and stations in Co-op City, Morris Park, Parkchester and Hunts Point, cementing the borough’s appeal for long-term investment.

2025 Mid-Year Outlook

The New York City commercial real estate market is entering the second half of 2025 with a complex mix of challenges and opportunities, driven by both global economic trends and crucial local policy shifts. While geopolitical tensions and elevated, albeit stabilizing, interest rates create a cautious environment, a significant surge in foreign investment and strategic development initiatives are bolstering confidence.

The “Big Beautiful Bill” brings significant capital investment incentives. Its permanent reinstatement of 100% bonus depreciation and the new allowance for “Qualified Production Property” will notably boost industrial development and redevelopment. This bill also permanently expands the LIHTC program, making affordable housing development significantly more feasible across the borough, particularly in areas with available land and a community need.

Despite political anxieties, strong market fundamentals persist. Multifamily demand remains robust across boroughs, driving growing rents and limited supply in the free market sector. Development is stimulated by “City of Yes” zoning reforms and the 485-x and 467-m tax abatements, encouraging new construction and office-to-residential conversions. The market is shifting from defensive to strategic capital deployment, focusing on location, asset quality, and adaptability.

The Bronx 2025 Mid-Year Commercial Real Estate Trends report is available here.