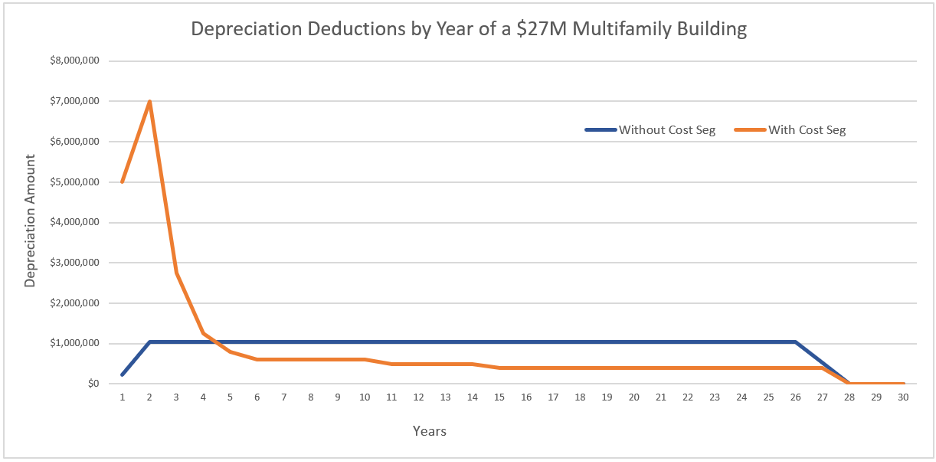

To a multifamily owner, depreciation is a big topic. Real estate investors have used the current 27.5-year depreciation schedule from the IRS for many years. This allows a “loss on paper” which helps reduce an investor’s tax burden. In more recent history, the US Federal Government introduced other programs further to increase the tax advantages of real estate investments.

Cost Segregation, originally created in 1962, allows owners to group property improvements and accelerate depreciation for some of them. A light bulb, for example, has a shorter useful life than a roof, so the light bulb is depreciated more quickly. Apartment complexes have many items, like light bulbs, ovens, and refrigerators, that offer faster depreciation through cost segregation. This ultimately front-loads the depreciation benefit.

In 2002, the tax rule called “Bonus Depreciation” was introduced. It lets investors write off up to 30% of the cost of their asset in the year they bought it. Then, in 2017, the Tax Cuts and Jobs Act passed allowing investors to write off the entire cost of those assets in the first year! Bonus Depreciation started phasing out in 2022 and will be completely gone by 2027.

These two depreciation methods (Cost Segregation and Bonus Depreciation) have become very popular with real estate investors in recent years because they have drastically reduced the taxable income for those years. Note: to be eligible for the tax credit, the filer must be recognized as a real estate professional as defined by the IRS. These opportunities have led to a change in how we look at a depreciation schedule. Please see the below example comparing depreciation benefits with and without cost segregation plus bonus depreciation.

If you depreciated so much from your earnings in the first few years of ownership, and not so much later, does selling the property and “reset” depreciation make sense? If you have held it for more than 4 years, you have probably made many improvements and the property should provide great cashflow. The property is almost fully depreciated if you take cost segregation and bonus depreciation.

This is a great opportunity for that owner to “reset” depreciation. When you sell a property and use the money to buy another one, you can start depreciating the new property all over again! This means you get to keep taking deductions on your taxes, even though you technically “repaid” the old depreciation. By using a 1031 exchange, you can delay paying back the depreciation until you’re older and presumably making less money.

In some partnerships, not all investors may be interested in participating in a new investment with the same group to complete the 1031 exchange. No worries, something called a “drop and swap” agreement can be utilized to change the investment structure to a tenants-in-common (TIC) structure. This would provide more flexibility for each investor’s future investments, including some reinvesting on their own and others completing a 1031 exchange. With the assistance of an attorney, this agreement can be completed before the original property sells.

While these strategies offer significant benefits, they can also have certain legal complexities. As such, it’s essential to consult with legal and financial experts before making any significant investment decisions.

If you’re a multifamily owner interested in exploring these options further, we would love to discuss them with you. We are not attorneys or CPAs, but we can provide valuable referrals to professionals while helping you navigate the process.

Author: Angel Flores