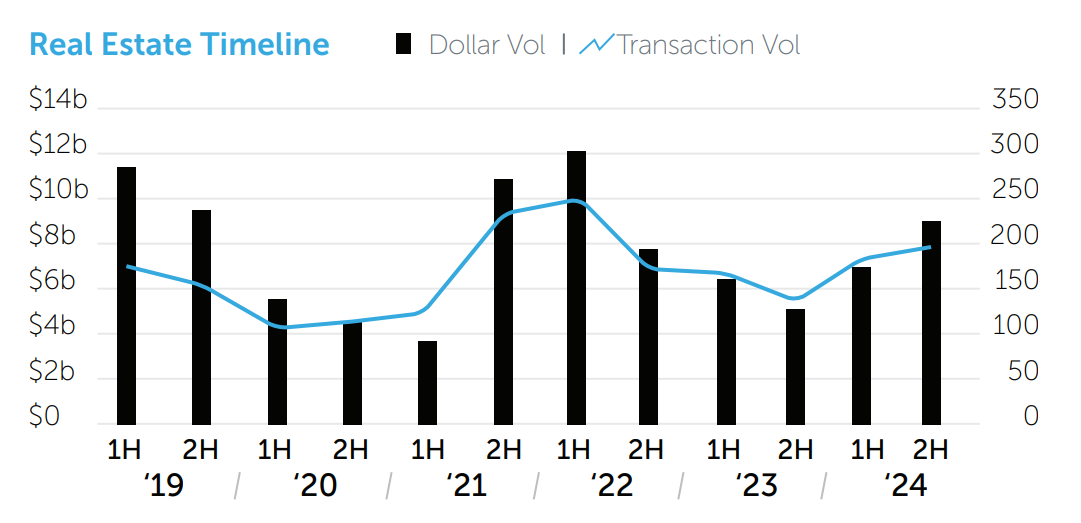

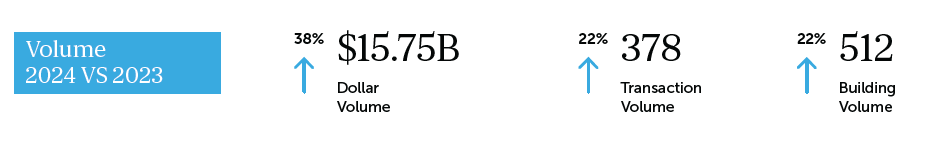

NEW YORK, NY – January 31, 2025 – Manhattan investment sales totaled $15.75 billion in 2024, a 38% year-over-year increase, according to the Manhattan 2024 Year-End Commercial Real Estate Trends report, produced by Ariel Property Advisors, a member of GREA. Transactions totaled 378, up 22% from the previous year.

“Manhattan’s commercial real estate market experienced a robust rebound in 2024, which reflected renewed investor and developer confidence,” said Ariel Director Howard Raber. “The office sector in particular showed signs of recovery, with a 74% spending increase over 2023 to $5.11 billion and accounting for 32% of total CRE dollars invested in Manhattan in 2024. Fifty of the 55 office transactions were for Class B and C office buildings that were mainly acquired by owner-users or investors seeking repositioning opportunities, while taking advantage of a 16% reduction in the average price per square foot.”

GREA New York Founding Partner Mike Tortorici continued, “Development site sales volume rose to $3.22 billion in 2024, an impressive 121% increase year-over-year. These figures were bolstered by a number of office-to-resi conversion transactions. The anticipated Midtown South rezoning plan is expected to progress in 2025 and should strengthen this trend, increasing residential development opportunities and the number of housing units in Manhattan.”

Director Christoffer Brodhead added, “Multifamily sales remained strong with a total of $3.44 billion in sales and contributing 22% to total investment sales in Manhattan last year. We saw demand for high-quality residential properties and even a renewed interest in rent-stabilized assets.”

Retail Highlights

- In 2024, the retail sector saw 57 deals valued at $2.23 billion, a jump of 54% and 46%, respectively, versus 2023.

- Pricing per square foot in 2024 was $1,780, 13% lower than 2023 but 42% higher than the 2022 average.

- The first half of 2024 signaled a strong recovery in retail, driven by luxury brands like Kering and Prada acquiring prime retail locations. Another notable transaction was the sale of 102 Greene Street in SoHo to a Japanese conglomerate for $46 million ($4,020/SF). The seller, RFR Realty, realized a $14 million profit over the $32 million paid in 2022 by delivering the property fully occupied with Cartier as the tenant.

- Retail leasing also showed significant improvement, with the availability rate dropping to a record low of 14.7% in Q3 2024, a notable turnaround from the 21% average availability rate in 2019 (pre-pandemic).

Multifamily Highlights

- Manhattan multifamily sales rose 11% year-over-year to $3.4 billion in 2024, while transactions remained relatively flat at 182.

- Predominantly free-market buildings accounted for 76% of the dollar volume and 73% of the transaction volume. Interest in rent-stabilized assets increased, however, supported by 24% of the transaction volume in 2024, up from just 12% in 2023, further indicating a market characterized by more distressed sales.

- Cap rates continued to rise, averaging 6.23% versus 5.24% in 2023, contributing to reduced property values as interest rates remained steady for most of the year. Pricing increased slightly for properties with less than 25% rent-stabilized units.

- The most notable transaction of the year was 20 Exchange Place, a 57-story luxury Art Deco skyscraper in the Financial District, which sold for $370 million. The 767-unit property was converted to apartments over 20 years ago.

Office Highlights

- The office asset class led Manhattan in dollar volume, trading $5.11 billion in 2024, a 74% year-over-year increase. Transaction volume also saw significant growth, ending with 55 transactions, a 77% increase from 2023.

- Among the 2024 transactions, five involved Class A properties, while the remainder were Class B and C assets. (NOTE: Office assets sold for residential use are included in the development numbers, not the office numbers.)

- The average $/SF for Manhattan offices sold in 2024 was $708, a significant drop compared to the 2019 average of $1,045/SF.

- The standout transaction was the sale of 2 Park Avenue in Midtown, where Morgan Stanley sold its 28-story building to Haddad Brands as an owner-user for approximately $357 million ($361/SF). The 30% discount from the building’s original purchase price of $519 million in 2007 highlights the sector’s devaluation due to the slow pace of employees returning to the office.

Development Highlights

- Dollar volume in Manhattan’s development sector totaled $3.22 billion in 2024, a remarkable 121% increase year-over-year. Transaction volume also rose sharply, climbing 82% to 60.

- Approximately 70% of the development dollar volume, or $2.3 billion, consisted of office assets sold for residential use, either conversions or demolition and ground-up redevelopment.

- The most notable transaction was the $160 million ($971/BSF) acquisition of 655 Madison Avenue, a 24-story Midtown office tower slated for demolition. Extell Development purchased the site with plans to develop a luxury condominium project potentially incorporating retail and hotel components.

- Average pricing for development sites rose to $418/BSF, marking a 7% year-over-year increase but remaining slightly below pre-2023 levels.

Hotel Highlights

- Hotel transaction activity remained stable with 14 deals, matching 2023’s total. However, dollar volume declined by 18%, falling to $1.47 billion. Notably, 72% of transactions were concentrated in Midtown.

- Hotel pricing averaged $932/SF, improving by 40% from the lows of 2020 ($660/SF) and 2021 ($671/SF), which were heavily impacted by the COVID-19 pandemic.

- The largest transaction of the year was the $288,519,430 sale of the 587-room Thompson Central Park Hotel at 111 West 56th Street.

- Tourism in New York City grew to 65 million visitors in 2024, the second highest figure on record and a 3.5% increase from the prior year. Citywide, hotel rooms have been lost because of conversions into 16,000 migrant housing units. However, even as migrant units return to the hotel stock, supply constraints will remain because of NYC regulations.

The Manhattan 2024 Year-end Commercial Real Estate Trends report is available here.