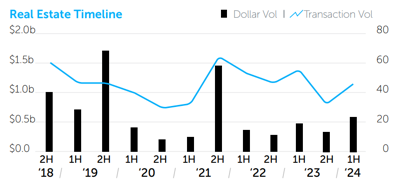

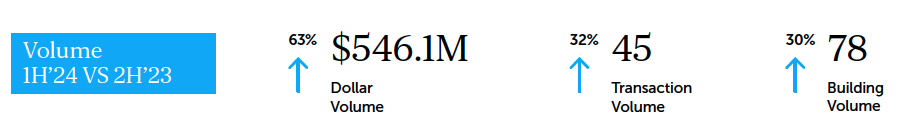

NEW YORK, NY – July 30, 2024 – The dollar volume of investment sales in Northern Manhattan jumped 63% to $546.1 million in 1H 2024 compared to 2H 2023, according to the Northern Manhattan 2024 Mid-Year Commercial Real Estate Trends report produced by Ariel Property Advisors, a member of GREA. Transactions also rose 32% to 45 over the period.

“Investment sales activity in Northern Manhattan showed strong improvement compared to the second half of 2023 driven in large part by two large sales,” said Ariel Property Advisors Founding Partner Mike Tortorici. “One was the $172 million sale of 1760 3rd Avenue, a dormitory that will be converted to affordable housing, and the other was the $38 million sale of 97 Claremont Avenue, which is a dormitory that is expected to be converted to luxury student housing.”

Ariel Associate Director Alix Curtin noted, “In the rent stabilized segment of the multifamily market, elevated interest rates and the lasting impact of the Housing Stability and Tenant Protection Act of 2019 (HSTPA) put downward pressure on valuations resulting in most of these buildings trading at an average of $116/SF and $95,757/unit, which represents a 33% and 40% decline compared to 2023 levels.

“In the development market, only four sites traded in Northern Manhattan in 1H 2024,” said Ariel Director Alexander Taic. “However, we expect to see an uptick in activity because of the state’s recent approval of a new housing policy that included the 485-x, a tax incentive for affordable housing development. In fact, Ariel currently has three development sites in contract in Northern Manhattan that will benefit from the new policy.”

The following is a summary of the performance the asset classes in Northern Manhattan in 1H 2024:

Multifamily

- Northern Manhattan saw 35 multifamily transactions valued at $249 million, which represented a 59% increase in transaction volume and 11% increase in dollar volume compared to H2 2023.

- Rent stabilized assets (buildings with 50%+ RS units) accounted for 62% of the total multifamily dollar volume.

- The largest rent stabilized sale was the approximately $290 million recapitalization of the Bronstein Properties 1,966-unit, 43-building portfolio split between Brooklyn, Northern Manhattan, and Queens. Approximately $102 million of the portfolio is in Northern Manhattan.

Development

- Four development properties valued at $37.3 million traded in 1H 2024, representing both the lowest transaction volume and dollar volume since 2011.

- Despite the small sample size, the average price per buildable square foot came in at $153.

- Urban Resource Institute’s recent purchase of 487 West 129th Street serves as a strong bellwether comparable sale for development pricing in Northern Manhattan given its size and prime location near Columbia University. The 153,000 BSF vacant site sold in June for $25.9 million, which equates to approximately $169 per buildable square foot.

Ariel Property Advisors’ Northern Manhattan 2024 Mid-Year Commercial Real Estate Trends report is available here.