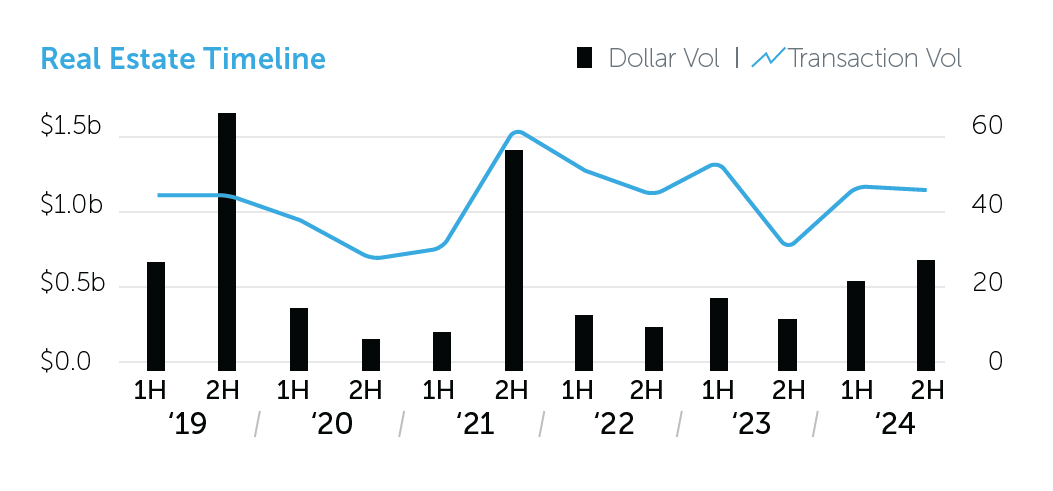

NEW YORK, NY – February 13, 2025 – The Northern Manhattan investment sales market recorded $1.26 billion in sales across 98 transactions in 2024, a 51% rise in dollar volume and 10% growth in transactions from the previous year, according to the Northern Manhattan 2024 Year-End Commercial Real Estate Trends report, produced by Ariel Property Advisors, a member of GREA.

“Northern Manhattan’s investment property market was bolstered by a rebound in development site sales, which rose by 168% year-over-year to $189.9 million in 2024,” said Ariel Founding Partner Michael Tortorici. “While the number of transactions remains low, the fact that several large deals over $20 million sold represents growing confidence from investors, especially with recent pro-housing policies like the 485x tax exemption, vested 421a extension and City of Yes initiative.”

Director Alexander Taic added, “In the multifamily market, buildings with at least 75% rent-stabilized units saw their transaction volume rise from 36% in 2023 to 48% in 2024, an increase largely driven by sellers coming down on price vis a vis elevated interest rates, mortgage maturities and adjustments needed with the 2019 HSTPA.”

Multifamily Highlights

- Multifamily sales in Northern Manhattan totaled $674.5 million in 2024, a 7% year-over-year increase, while transactions increased 11% to 69, marking the highest levels in the past five years, though still well below pre-HSTPA levels.

- Pricing metrics for buildings with 75% or more rent stabilized units reflected the strain of the HSTPA regulation, with the average price per square foot falling 20% year-over-year from $164 to $132. A sale illustrating this trend was 720 W 181st St, which traded for $32 million in 2017 but resold in 2024 for just $10.4 million, a 68% decline.

- The affordable housing sector accounted for 35% of multifamily dollar volume and included 226 & 259 W 144th St and 34 W 139th St, brokered by Ariel Property Advisors, which sold a month apart for a combined $48 million.

Development Highlights

- Development sales in Northern Manhattan totaled $189.9 million, a 168% increase from the previous year, across 16 transactions, a 14% increase.

- Pricing for development sites remained flat at $160/BSF, however.

- A significant transaction was Extell Development Company’s $70 million sale of 167 East 124th Street, a vested 421a development site with a FRESH Zone bonus that will be located next to the soon to be expanded Second Avenue Subway.

The Northern Manhattan 2024 Year-End Commercial Real Estate Trends report is available here.