Multifamily Operators Face Rising Expenses Amid Plateauing Rents

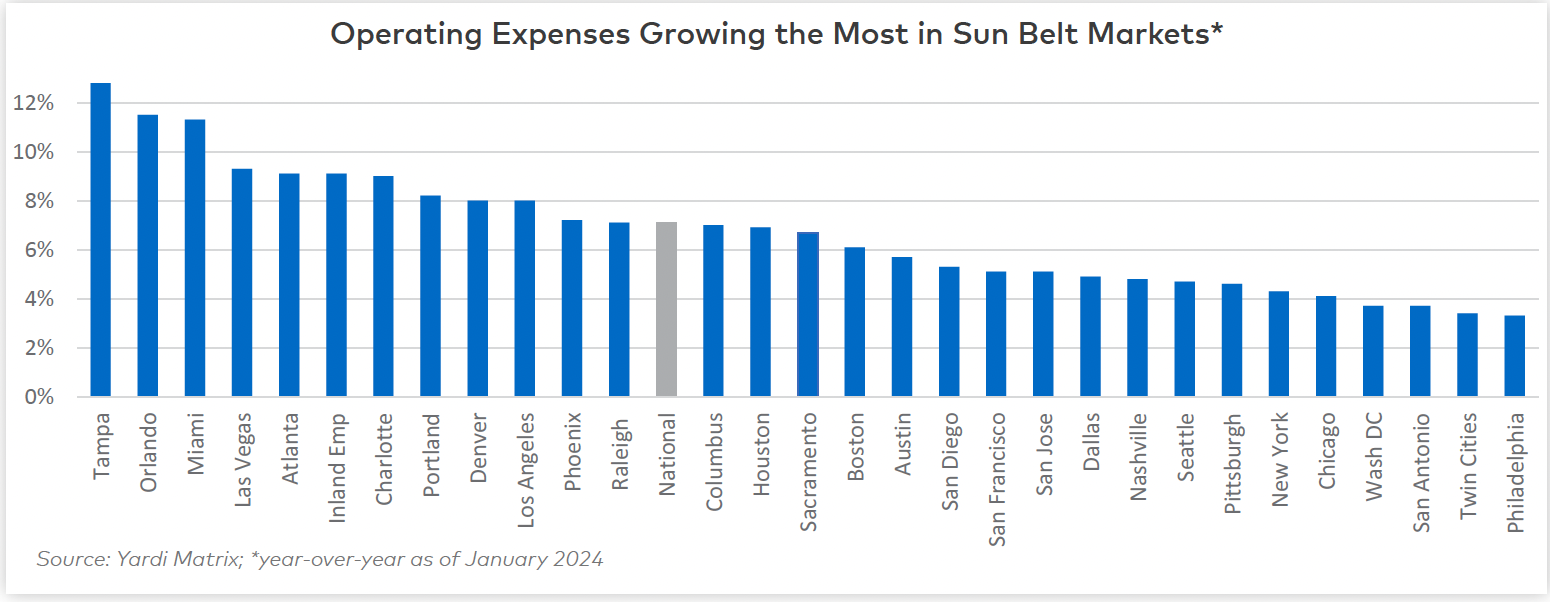

While multifamily rents across the nation barely inched up over the last year, increasing just 0.9% as of March year-over-year, expenses saw a big jump, up 7.1%, led by rising insurance costs, according to reports from Yardi.

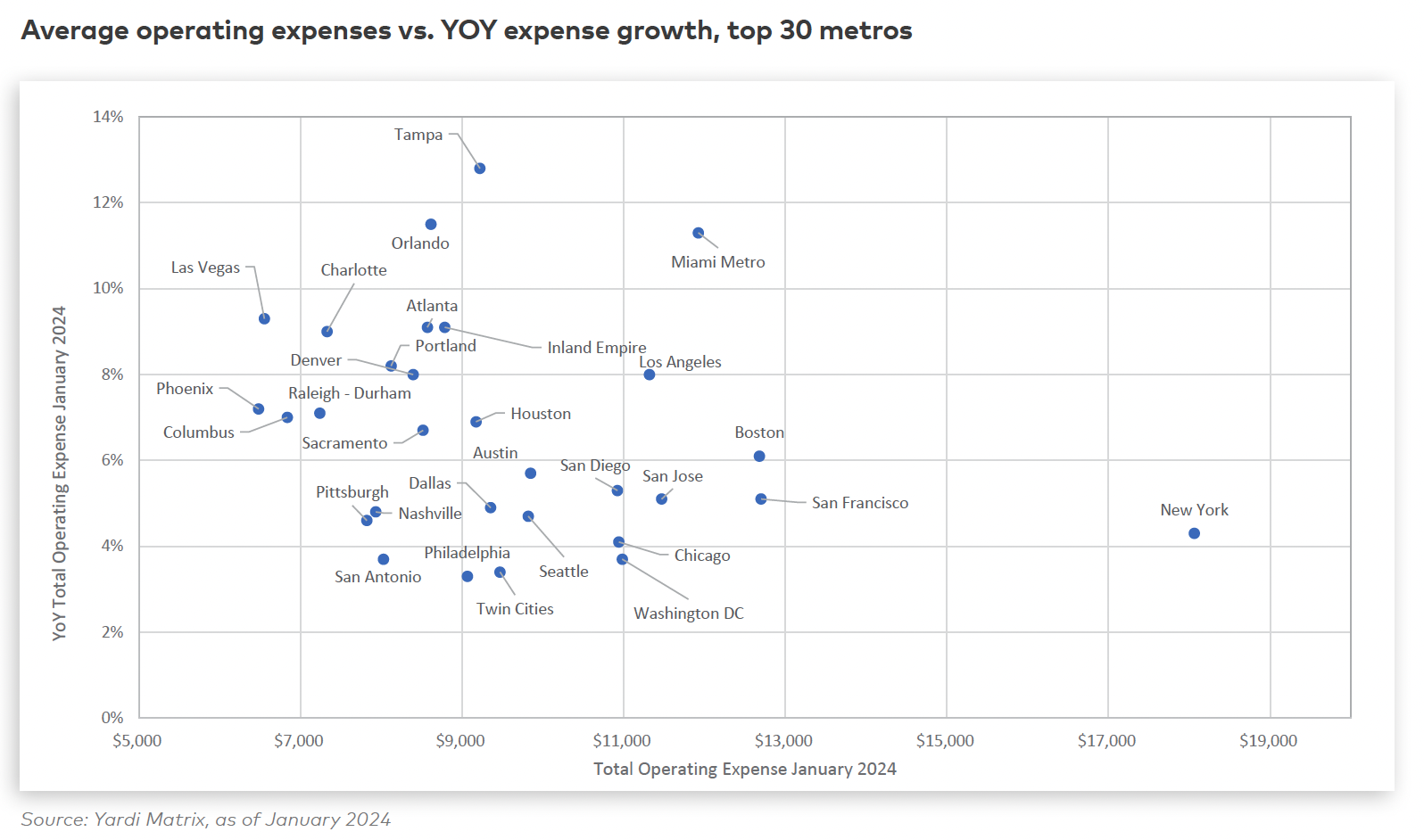

The slight bump in rents translates to an $8 monthly improvement, while the rise in expenses per unit averages $593, based on data from January 2023 to January 2024. Overall, this brings the average expenses per unit to $8,950. The numbers are based on over 20,000 properties using Yardi operating software across 129 markets. Among the markets studied, 28 experienced a 10% jump or more in expenses.

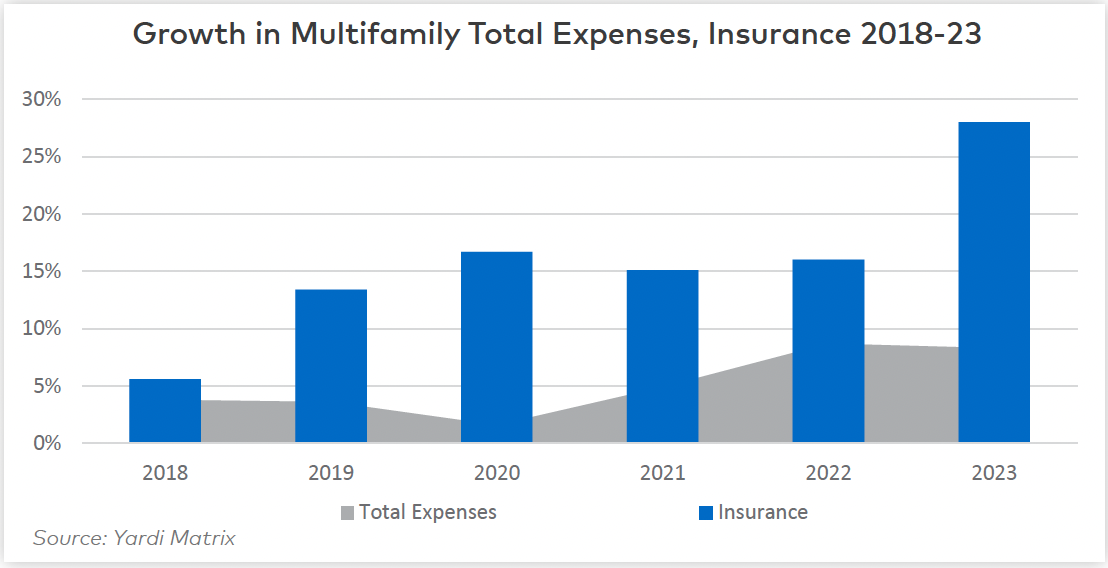

Before 2022, expenses were rising at a much slower pace, averaging just 4.9% in 2021 and up 1.6% in 2020 and 3.6% in 2019.

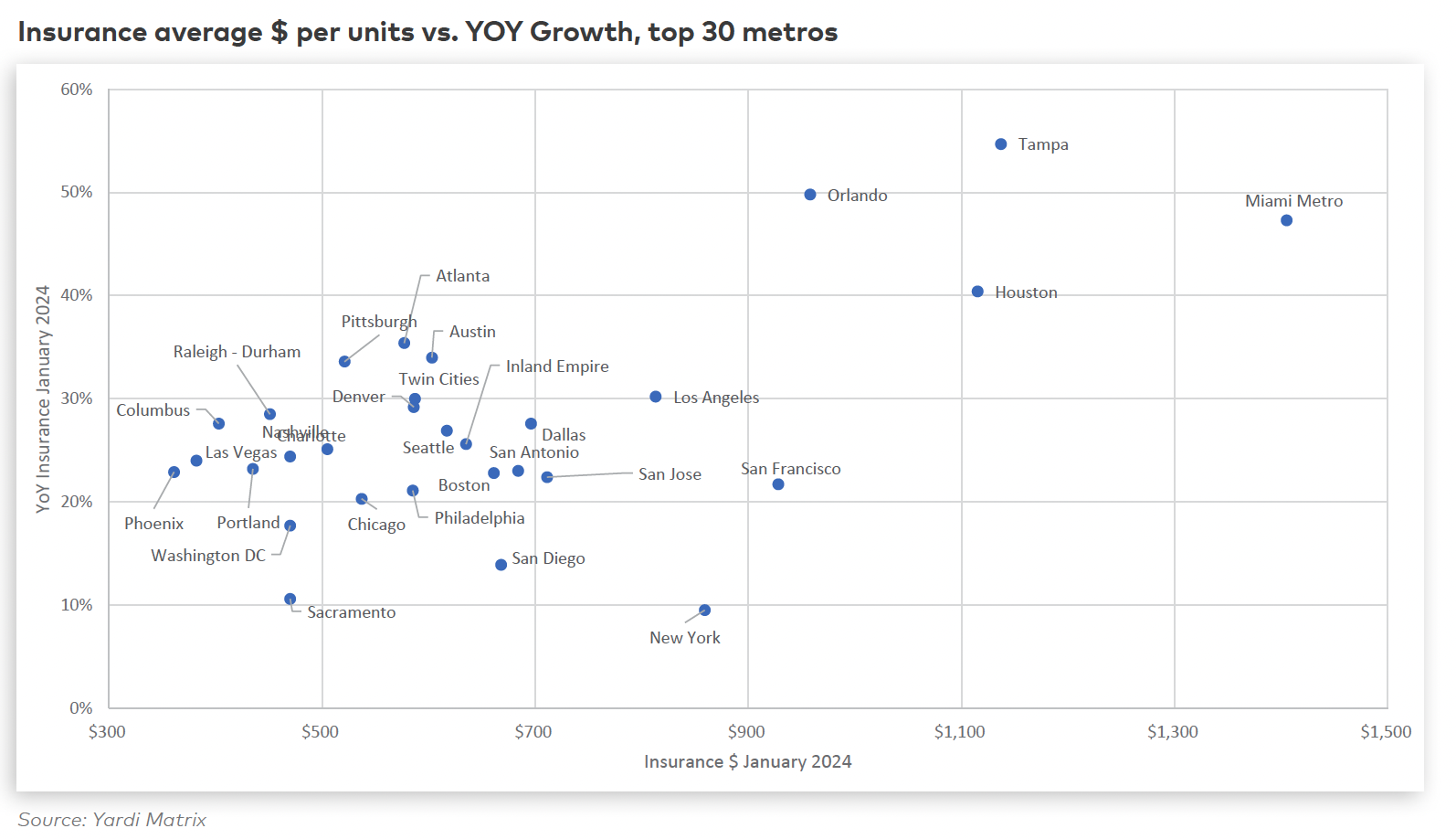

Among expenses, insurance saw the biggest annual spike at 27.7%, followed by marketing (12.3%), administration (9.6%) and repairs and maintenance (8.8%). The lightest increase went to management, up just 3.2%. Among the expense categories, insurance represents just 7% of total expenses on a national basis.

Prior to the spike in 2024, annual insurance costs were only up by 5.6% in 2018 but began to see double-digit increases in 2019 (up 13.4%), followed by 16.7% in 2020, 15.1% in 2021, and 16% in 2022.

By region, the Southeast led with the biggest overall increase in expenses at 8.8%, followed by the West (7.3%). The Northeast had the lowest increase at 4.6%, while the Southwest stayed below the national average at 6%.

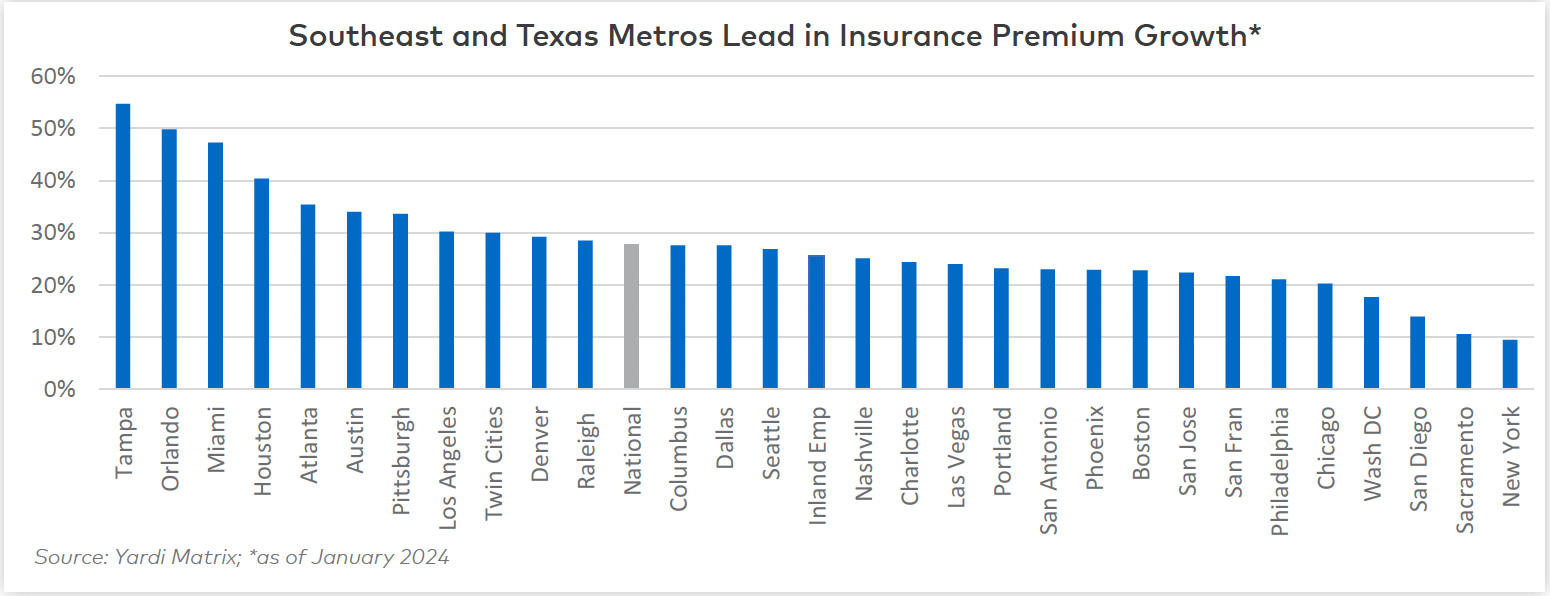

The Southeast was also No. 1 for the biggest jump in insurance premiums, where costs rose 35.7%, followed by a 29% increase in the Southwest. The Northeast was again at the bottom with a 21.2% increase.

On a more granular level, the markets hit with the biggest increases in expenses were Spokane, WA (18.9%); Tallahassee, FL (18.8%); Lafayette, LA (18.1%); Portland, ME (14.7%); and Pensacola, FL. (14%).

However, the markets with lower expense increases were also markets that had the highest expenses overall. For example, Manhattan has an annual expense per unit of $20,170, compared to the national average of $8,950, but expenses only rose 4.6%, well below the national average.

Not surprisingly, many of the markets with the biggest jump in insurance premiums were in Florida. Tallahassee insurance surged 131.9%, followed by Mobile, AL ( 80.6%), Pensacola (73.5%), and the Southwest Florida Coast (69%).

Three markets saw a decline in insurance costs, with Fort Wayne, IN seeing a 2.5% percent decrease, followed by White Plains, NY (-1.5%) and Little Rock (-1.4%). Anchorage and Oklahoma had minimal respective increases of 0.8% and 0.3%.

Author: Esther Cho