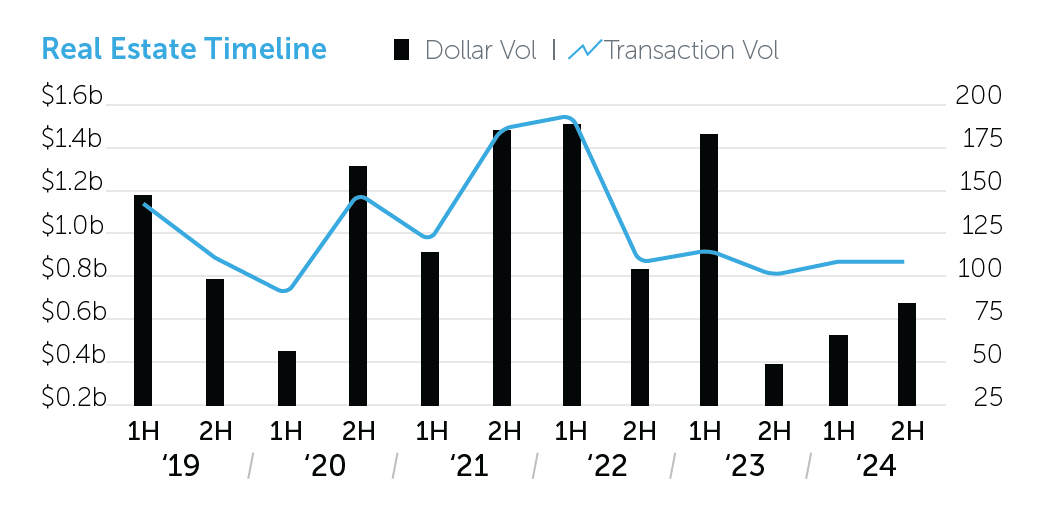

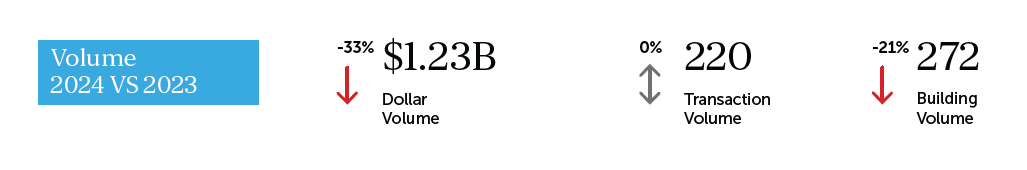

NEW YORK, NY – February 4, 2025 – In 2024, the Bronx investment sales market saw steady activity with 220 trades, but dollar volume fell 33% to $1.23 billion, the lowest level since 2011 and the sharpest decline among all the New York City submarkets, according to the Bronx 2024 Year-End Commercial Real Estate Trends report, produced by Ariel Property Advisors, a member of GREA.

“The decline in investment sales activity last year stemmed from the lack of institutional transactions, with only one sale exceeding $50 million,” said Ariel Senior Director Jason Gold. “The development market, however, stood out, with dollar volume rising by 39% and accounting for nearly 30% of total sales. It was the only asset class to grow in both transaction and dollar volume, fueled by the Metro-North Rezoning of a 46-block area, 485-x legislation and the extension of vested 421-a sites.”

Director Daniel Mahfar added, “Special-purpose assets also saw a resurgence, with dollar volume up 258% year-over-year to $151.66 million. Two homeless shelter deals drove two-thirds of the activity: Urban Resource Institute’s $64 million purchase of 951 Olmstead Ave. and Care for the Homeless’s $46.4 million acquisition of 1364-1400 Blondell Ave.”

Multifamily Highlights

- Transaction volume rose 10% year-over-year to 90, driven by significant growth in sales of buildings with fewer than 10 units. However, dollar volume declined 59% compared to 2023 to $457.9 million, marking the lowest level in 13 years.

- In 2024, 29% of the transactions involved assets with less than 25% rent stabilized units (or 421a properties), up from 21% in 2023. Pricing for these assets surged 34% year-over-year to $352/SF, driven largely by new development sales. Meanwhile, rent-stabilized properties made up 53% of transaction volume, down from 59% in 2023. These trends brought the overall average price to $186/SF and $152,000/unit—both increases over 2023.

Development Highlights

- Development sales in the Bronx totaled $363.1 million in 2024, a 39% increase year-over-year, while transactions totaled 59, a 7% increase. Both dollar and transaction volumes were the fourth highest ever recorded for the borough.

- New building filings in the Bronx surged 112% year-over-year in Q3 2024, totaling 53 filings, compared to a 5% citywide decline. The uptick, driven by the Bronx Metro North Station Area Plan, approved in August, 421a extension, 485-x, and the borough’s affordability, pushed the price per buildable square foot to a record $107, up 9% from 2023, signaling growing demand for vacant land.

- One notable sale reflecting the impact of 485-x was 36 Bruckner Blvd., brokered by Ariel Property Advisors for $9.85 million ($131/BSF). The site is expected to house 99 residential units, a trend likely to grow as developers aim to avoid wage mandates tied to 100+ residential unit buildings.

Retail Highlights

- The Bronx retail sector experienced a 24% drop in dollar volume compared to 2023 to $114.9 million and 6% decline in transactions to 32.

- Despite activity declines, the price per square foot rose to $476/SF, a 7.7% increase from 2023, but retail pricing metrics are still not nearing the $532/SF highs of 2021 and 2022.

- The most expensive transaction in 2024 came via a foreclosure sale–151 East 170th Street, a 1-story, 8-unit, 9,700 SF retail property sold for $8.6 million ( $881/SF).

Industrial Highlights

- The Bronx industrial sector continued its decline in 2024, with dollar volume dropping 46% to $118.2 million and transaction volume falling 29% to 25 trades, the lowest dollar volume since 2014 and the lowest transaction volume since 2011.

- Despite the downturn, the $/GSF climbed to $471, and $/lot SF increased slightly to $255. However, these figures were skewed by one sale: 891 East 135th Street, the largest industrial trade of the year, sold for over $12.5 million ($712/GSF) to Waste Connections from Royal Waste Property Holdings, likely reflecting its value as a fully built-out facility for waste services, a strong fit for an owner-user.

The Bronx 2024 Year-End Commercial Real Estate Trends report is available here.