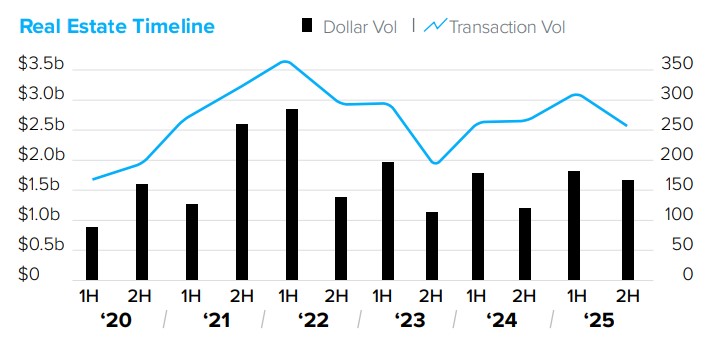

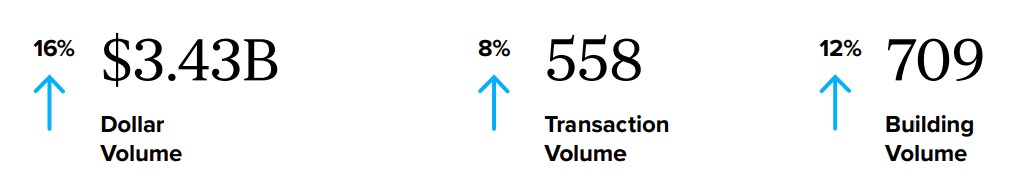

NEW YORK, NY – Investment sales in the Queens market totaled $3.43 billion in 2025, a 16% increase from 2024, according to GREA Queens 2025 Year-End Commercial Real Estate Trends report. Transaction volume rose by 8% to 558 deals.

“We saw a significant increase in investment sales activity in Queens last year,” said GREA Partner Sean R. Kelly, Esq. “Most notably, development sales jumped over 40% year-over-year, driven by initiatives such as the 485x tax incentive, City of Yes, strategic rezonings in Jamaica and Long Island City and the green-lighting of a new casino complex next to Citi Field.”

Multifamily Highlights

- Multifamily dollar volume totaled $879 million, a 3% increase from 2024, while transactions rose 4% to 264 trades.

- Buildings with fewer than 10 units drove 39% of total multifamily transaction volume as investors targeted small, unregulated free-market properties in Astoria, Long Island City, Flushing, Sunnyside, and Jackson Heights. The vacancy rate in Northwest Queens hovered near 2%, and median rents there rose 1.5% to $3,510.

- The largest transaction was Black Iris Capital’s acquisition of the LeFrak Organization’s South Queens Multifamily Portfolio for $109.5 million. The 721,456-square-foot portfolio includes 755 residential units across nine properties in Richmond Hill.

Development Highlights

- Dollar volume in the development sector soared 41% year-over-year to $627.82 million. Transactions rose 38% to 77 trades.

- Momentum was driven by the City of Yes and rollout of the 485x and 467m tax abatements, which incentivized new residential towers and high-density mixed-use projects. Recently approved rezonings in Long Island City and Jamaica also are expected to attract additional development capital, further reinforcing long-term growth and investment activity throughout the borough.

- The largest transaction in the second half of the year was Domain Companies and the Vorea Group’s $37 million acquisition of 35-42 and 35-45 41st Street in Astoria where they are planning a two-tower residential project with 429 total units.

Retail Highlights

- The Queens retail sector closed the year with $637 million in dollar volume, a 28% increase over 2024, and transactions held steady at 86 deals. Pricing stayed in line with 2024, averaging $698/SF.

- The borough’s largest retail transaction was in Glendale, where Ashkenazy Acquisition Corp. acquired a 374,000-square-foot, four-story building with 90 units at 80-00 Cooper Avenue for $72 million, or $193/SF.

Industrial Highlights

- The Queens industrial sector remained a key pillar of market activity in 2025, despite a 13% year-over-year decline in total dollar volume to $635.8 million. Transactions increased 8% to 83 deals and the price per square foot came in at $551, a 2.5% decrease compared to 2024.

- The most notable transaction was Morgan Stanley’s $86.7 million ($682/SF) acquisition of an industrial site at 83-15 24th Avenue in East Elmhurst from Blackstone. The 127,112-square-foot site spans two properties occupied by FedEx, reinforcing sustained investor demand for well-located industrial assets.