Mortgage Maturities Main Driver for Activity in Multifamily Market

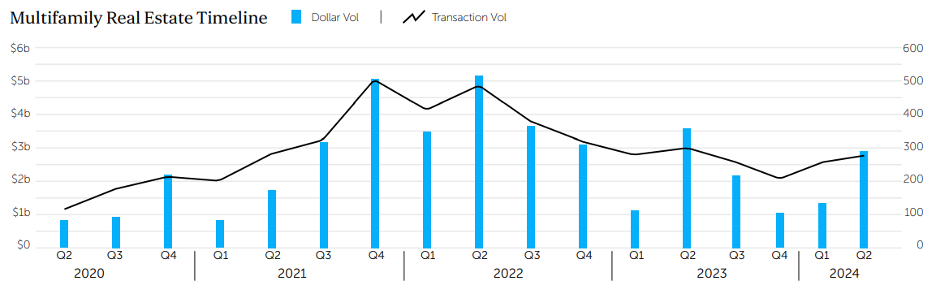

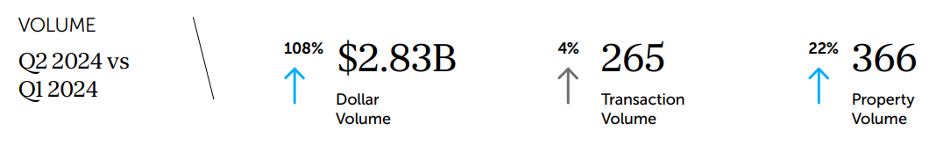

NEW YORK, NY – July 25, 2024 – New York City saw robust activity in the multifamily market in Q2 2024 with dollar volume totaling over $2.8 billion, 108% higher than the previous quarter and the best quarter since Q2 2023, according to the Q2 2024 Multifamily Quarter in Review New York City produced by Ariel Property Advisors, a member of GREA. Transaction activity rose 4% to 265 deals.

“Mortgage maturities were one of the main drivers for multifamily sales in the second quarter and we expect this trend to continue, especially for rent-stabilized assets, which accounted for over 50% of the Q2 transaction volume,” said Shimon Shkury, President and Founder of Ariel Property Advisors. “There is an abundance of capital available for all multifamily assets today: institutional, private and international capital for free market; private family offices for rent stabilized; and mission driven for Affordable Housing. Our report shows that pricing has drastically adjusted in all categories of the multifamily market with investments in rent stabilized buildings driven by values dropping by roughly 30 to 60 percent.”

Mortgage maturities played a role in two prominent free market sales in the second quarter including:

- The bulk condominium sale of 503 residential and retail units at 9 Dekalb Ave in Downtown Brooklyn for $672 million through a deed in lieu of foreclosure. The mezzanine lender, Silverstein Capital Partners, took over for JDS Development after purchasing the senior loan from Otéra Capital.

- Carlyle Group and Gotham Organization bought 200 West 67th Street for $265 million. A&R Kalimian Realty, the seller, sold the building due to a mortgage maturity and expiration of a 421a tax exemption.

Multifamily Submarket Highlights

Brooklyn. Brooklyn recorded the highest dollar volume of all the submarkets in Q2 2024 rising to $1.45 billion, a 233% jump compared to Q1 2024. Transactions during this period totaled 116 a slight decline of 7%. Year-over-year, dollar volume jumped 84% and transactions fell 12%. Sales of predominantly free market buildings dominated in Q2 2024, accounting for 78% of the dollar volume and 60% of the transaction volume in Brooklyn.

Manhattan below 96th Street. Manhattan’s multifamily dollar volume totaled $763.4 million in Q2 2024, a 20 percent increase from Q1 2024, and transactions totaled 46, a 7% increase over the same period. Year-over-year dollar volume fell 44% and transactions declined 28%. Predominantly free market assets accounted for 65% of the dollar volume and 50% of the transactions in core Manhattan.

Queens. Queens multifamily dollar volume rose to $302 million in Q2 2024, a 120% increase quarter-over-quarter and 17% increase year-over-year. Transactions totaled 65, a 23% increase from Q1 2024 and an 18% increase from Q2 2023. Predominantly rent stabilized sales accounted for most of the trades with 60% of the dollar volume and 82% of the transactions for the quarter.

Northern Manhattan. This submarket’s dollar volume increased 201% to $195.1 million in the first quarter compared to the previous quarter while transactions fell 29% to 14. Year-over-year, dollar volume fell 37% and transactions dropped by 43%. Rent stabilized buildings dominated sales in the quarter accounting for 76% of the dollar volume and 43% of the transactions.

The Bronx. The borough saw a modest $125.7 million in dollar volume across 24 transactions in Q2 2024, a 46% and 82% increase, respectively, versus Q1 2024. Compared to the same quarter last year, the dollar volume fell 86% percent and transactions declined by 9%.

Of the Q2 2024 trades, free market accounted for 60% of the dollar volume and 31% of the transaction volume while rent stabilized accounted for 32% of the dollar volume and 62% of the transactions.

The full Multifamily Year in Review New York City report is available here.