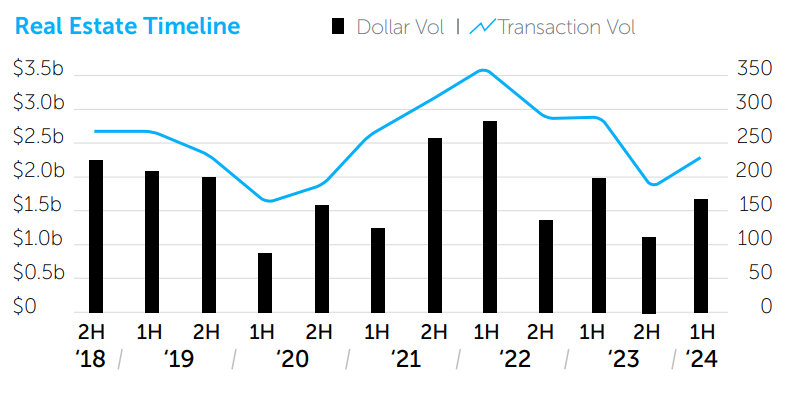

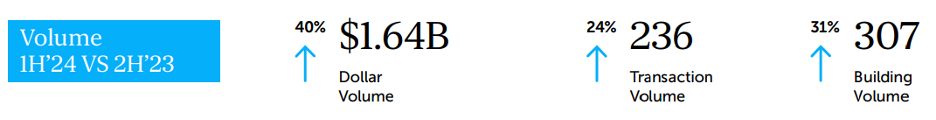

NEW YORK, NY – August 1, 2024 – After bottoming out in the second half of 2023, investment sales in Queens rose to $1.64 billion over 236 transactions in 1H 2024, a 40% and 24% increase, respectively, compared to 2H 2023, according to the Queens 2024 Mid-Year Commercial Real Estate Trends report produced by Ariel Property Advisors, a member of GREA.

“Multifamily and industrial sales together accounted for more than half of the investment sales dollar volume in Queens in the first half of the year,” said Ariel Partner Sean Kelly. “The largest multifamily transaction was a 506-unit affordable housing portfolio sold by Lefrak City to Black Iris Capital for $71.5 million. The new owner plans to renovate the building infrastructure and units in partnership with HPD, maintaining affordability status for the next 40 years.”

The first half also saw owners partnering with equity providers or finding other creative ways to stay in deals. For example, the Parkoff Organization recapitalized the almost-fully rent-stabilized Bronstein Portfolio located across Queens, Brooklyn, and Northern Manhattan. The estimated Queens portion was $68 million.

In the industrial market, about 50% of the total dollar volume came from Blackstone’s sale of a national industrial portfolio to Terreno, with the Queens portion valued at $246 million, which translates to $493/SF.

The following is a summary of the asset classes in Queens in 1H 2024:

Multifamily

- Multifamily dollar volume increased 49% to $425.4 million, and transactions increased 23% to 117 in 1H 2024 from 2H 2023.

- Of the transaction volume, 60% was for small multifamily buildings (less than six units) and only five out of 117 transactions were over $10 million. No purely free market multifamily traded in Queens in Q2 2024.

- Nine out of the top 10 transactions were predominantly rent-stabilized. Of those, two transactions were bankruptcy sales.

Industrial/Warehouse/Storage

- In H1 2024 compared to H2 2023, the industrial sector saw a healthy 78% increase in the dollar volume to $432.3 million, while transaction volume grew by 24% to 31 transactions.

- As part of a four-building purchase spanning Brooklyn and Queens, Carlyle acquired a self-storage facility at 87-16 121st Street in Richmond Hill for $50.3 million. This price is more than four times the $11 million the sellers paid for the property in 2018.

- Overall, Queens industrial assets saw an 18% increase in $/SF from $446/SF in 2023 to $522/SF in 1H 2024, the highest price on record.

Development

- The development asset class saw a 10% increase in dollar volume to $312.2 million in 1H 2024 compared to 2H 2023, and transactions rose 19% to 31 over this period.

- The largest transaction was United Construction and Development Group’s $57.5 million purchase of 42-50 24th Street. The sellers acquired the asset in 2015 for $69 million.

- ZD Jasper acquired a Long Island City residential development site at 45-28 & 45-40 Vernon Boulevard for $47 million. A rezoning variance was approved in June 2023 allowing for a 23-story, 226-unit building.

Retail

- The retail asset class posted $277.8 million in dollar volume, a 136% increase from 1H 2023 and the best half since H1 2022. Transaction volume grew by 41% over this period to 41 transactions.

- Pricing of $724/SF was the highest since 2018, due in part to six deals that sold for above $1,000/SF including 104-15 Queens Boulevard and 146-26 Northern Boulevard, which are likely covered land plays with existing retail leases in place.

- Madison Realty Capital’s $80 million acquisition of 41-60 Main Street in Flushing through a bankruptcy-forced sale was the largest transaction in Queens since 2022.

Ariel Property Advisors’ Queens 2024 Mid-Year Commercial Real Estate Trends report is available here.